Passion for Design at your complete disposal

E F-L Sinatra

Portfolio

Design software to manage companies' financial risks

GDRD-Santé software that helps bank directors know the financial risk associated with their corporate clients.

Contribution

Client

Team

Design Strategy

Coach design thinking

User Experience

Prototype

Lead User test

Desjardins Entreprise

Mehdi Alohi (Product Owner), Ionel Murgia (IT director), Helene Marleu (SME), Eric Deschenes (SME) Enrico Sinatra (UX) Cecile (UI) Catherine Henye (Scrum Master) Marie Pier Pressé ( PM)

What we did:

Your solution involves creating an IT entity that combines financial information to evaluate the risk of a company defaulting and links this information with legal advice to help financial analysts comply with Canadian financial regulations.

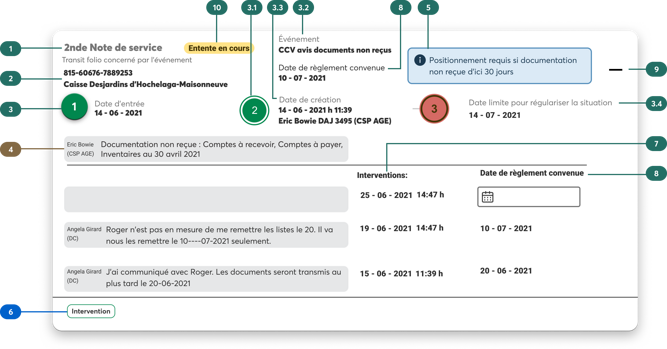

01 Title: explain if this is an NDS (Service note) or Position note

02 Number to identify a bank, client and compte

03 Number that explains the timeline ( when the accident happened, when the NDS was created and how much time we have to finalize and resolve the issue

03.02 Type of financial event, the reason why the NDS was Automatically created

04 Name and last name or AI intelligence that notify the financial accident

05 AI: provide legal information about the nature and the time that the user has to solve the accident

06: Button to add a new comment, interventions and new date to solve the financial accident

07 list of the date when all interventions happened

08 Date of the new agreement

09 Open and close the NDS

10 Status of the NDS.

How I did it

I organized more than 30 ateliers. Every Thursday, we met to create the user journey and see case by case (risk by risk)

after two weeks, we met every Friday to make some design sprints and draw the first screens of this application. (Thursday and Friday) so we had time to study and create during the week.

Hi I am Helene & Eric, we are an artificial intelligence and we are here to help you understand what it is financial risks?

Read this to understand : "What is a financial risk?"

Imagine a risk as a disease, a simple cold, and if left untreated, it can become a fever. Or a simple cough may be the event that demonstrates a more severe illness.

Each financial risk has a different legal treatment time.

Imagine a company as a patient and a risk as a disease: a cold can become pneumonia, or a cold is a symptom of cancer or mononucleosis.

A doctor's job is to analyze; A financial analyst's job is to examine the financial report to understand what kind of risk the enterprise faces and give suitable suggestions.

What is a financial risk?

Research:

Discovering

Problem's description

The main problems financial analysts face when managing financial risk enterprises are that: 1 they do not have an overview of the enterprise, 2they cannot create a risk hierarchy, and three they do not have any automation.

From a legal point of view, all financial products bought by an enterprise at a legal risk cannot be used by the bank. The consequence of whatever financial risk associated with whatever enterprise is directly connected with the bank's power to make investments. ( legal point of view)

And last but not least:

Each financial analysts have a considerable amount of documents to filter and create. Any tools used were tailored to help the final customer (enterprise).

.png)

I lead 30 design-thinking to discover the AI Solution with my team

After 3 months we had our first prototype :

Developing UX pattern

Co-creation is the tool to improve and align working groups. I am a leader, and I always carry on these work practices. We outlined ten goals, for example: what AI was supposed to do, how it could learn, and how the application would help make an informed decision

Scenario driven user journey: find UX pattern

I used the user journey to collect all the information necessary to carry out the financial's risk control activity.

We classified necessary financial information over time and added it to each step of the user journey to better understand how much and how much information should be considered to make the right decision for the final consumer.

The goal of the user journey was to understand which kind of financial information was needed to take action and a decision and for which case scenario the financial analyst should take any decision.

It was particularly vital because we should avoid enterprise default and give suggestions before the enterprise was declared in legal default.

After I had all the information, I suggested the goal of understanding which (data) was common to all financial risks. I showed the result, and we agreed that we had a significant common and shared overview and vision of the project.

Entreprise language and basic design

The first concept created was in line with the language and pattern of large industrial projects. Financial management software always has the same characteristics: a dashboard, a financial report page, and the products or entities to be modified. In this case, we also had the recommendations page

I lead & organized 30 design-thinking workshops.

Final outputs: a new userjourney that make sense for each user; a prototype; a presentation.

Representative images of the steps and results after the various workshops organized with customers.

Summary of the userjourney and how AI is interacting with the different data to prevent risk

Here I described what we discovered unexpectedly.

Long term impact

Once upon a time, it happens to work in a group where innovation and well-being become the only priority.

Once we realized what we had invented: A new computer entity that solved so many problems.

We started presenting the idea to the various internal groups and discovered that we had done a job that managed to summarize and solve the needs of large groups.

About 19 people in a working group can take advantage of the project. We had also solved a problem unknowingly.

A simple employee enters the bank using software and will use the same software when after ten years, he becomes a director or senior financial analyst. There will be no need to learn new software, and everything will be the same. (the accesses and companies it can finance will change: from 10k to 3 million)

Users:

Summary images of the project.

various professionals must manage a part of the risk, like in an assembly line. Each specialist is interested in seeing only one part of the financial data, but each wants to have the big picture.

Delivering

Prototype on figma, test with real users : Summary images of some screens (all screens are transactional) and according to the risk they change their function.

.png)

.png)

Control space, menu and rapid tools.

Enterprise personal information and general finance and legal entity.

Personal and detailed information, status, and social activities.

Product:

This was our first prototype. After the user test, we understood that we needed a common ground (then the IDEA of NDS born a kind of reel, a story of financial risk)

.png)

Dashboard and NDS are linked; users can check each NDS via Statut.

AI suggest positioning when required ( by studying past history and actual behaviour)

Our Improvement with real users

The first 3 steps

Like all financial software of respect, the first thing to do is to see if there are notifications and one of the urgencies, Companies that must be treated as a different priority. (information note there are risks, such as uncovered checks that must be processed within 6 hours, and other kinds of financial risks, such as a CCV, a moratorium that, according to the laws, has a timing between 15 and 45 days)

Search and search fields must be done in a way that can easily find priorities (and AI must be able to learn)

Once in front of the financial profile, the user must quickly get a quick idea of the products and guarantees held by the company.

Note: a company can also have 300 different guarantees, a filter within the guarantees and guarantees relating to the various precursor signs of risk

The financial risk become serious, so The NDS become NDS -P ( P is to describe that the user need to investigate deeply ) to find a solutions. ( and AI started to study what human do to help entreprise)

.png)

.png)

The last 3 steps

When a precursor sign of financial risk is born, it must be taken into consideration; we have inserted a precursor sign of financial risk in the NDS (note de service). We could have called it in many ways, but we decided to call it NDS, because, before computers in jargon, they were called notes, and bank managers gave service by creating opportunities to avoid defaulting companies in economic difficulty.

An NDS, can be something trivial, like forgetting to pay a bill, an employee who has left on sick leave, and nobody can do his job (true facts), or something much more severe. Such as a frequent turnover of personnel, unsecured growth, a new competitor, a bereavement, or a divorce (in family businesses, a divorce or bereavement was an indication of financial risk)

We invented NDS, because it did not exist before, and we needed to identify the precursor signs of risk from severe to less severe in two groups. (a risk is not something stable and tangible and something mobile and intangible)

Each risk has its duration, ranging from a few hours to a maximum of 90 days.

After 90 days, a legal financial positioning must be created. (the law wants it)

Positioning is a re-evaluation of all the guarantees of the held whole and a recipe for exiting the risk category. Unresolved risk leads to legal default.

Impact:

What is a financial risk?

Precursor sign of financial risk

Discovering real solidarity

We know the customers one by one, and so we have saved them one by one.

Clients : Hélène et Eric

Designer :Me

Why is managing financial risk important?

A company that declares legal bankruptcy certainly impacts its current and future community. It also exposes all employees to financial risk. And this project had the value and courage to take into consideration this impact and really help the community.

There are about 22 types (a risk is like a disease, and we give medicine to solve the problem). Sometimes it's urgent, and sometimes you need a recovery plan.

"Without risk management software, many businesses have been left alone, without the right knowledge and time, problems were untreatable."

Scenario storyaboard of a real life exemple

Roi & Impact:

We created an intelligent tool that prevent companies's financials risks with a notice period of 24 months

Before

After

20 clicks to finish a reports

1 platform for all users in the same company. Decrease of a mistake by 80/90 %.

>Respect of the financial regulation of Canada.

457 clicks (on average per risk) more than 12 software/applications to solve and finish the work. 20% of human mistakes in each report.

>Not in line with the Financial regulation of Canada.

Customer Satisfaction (CSAT)

Absence of any legal advice inside any platform. Each user should search for legal advice in the database

Legal advice inside any platform.

Powered by AI- ( start to study) project en course.

1 FINTECH APPLICATION. To do all the job.

More than 54 applications in total to make all different work. ( many of them are not at all user-friendly) quite complicated.

Net promote score

Absence of whatever esthetic.

Nice-looking software brings an enthusiastic feeling among employers and the adoption.

The design system reduces by 20 % the time of development.

User Engagement

We can calculate, on average, how much time the user spends to finish a task. We know that going to several applications to find information to complete the job was: (in general) time-consuming.

Automating the main task reduces the time between 30 and 90 %. (depending on the job)

Activation rate

In this case, we calculate the number of tasks completed weekly.

Did not change. What changed was the number of pieces of advice given to the users ( we improved the quality of the service) as secondary effects.

Revenue Growth

This is an internal project made to decrease the number of defaults.

By creating a better service, we empower the user, and ultimately the number of defaults will decrease.

Internal Awards:

Recognition obtained by Desjardins for the project

.png)

After this project as Senior Enterprise Designer, I became Lead UX designer for the ServiceNow platform.